Get Paid Faster by Offering Multiple Payment Channels

Customers who pay electronically tend to pay more quickly and electronic payments are more efficiently processed and reconciled. In order to encourage more customers to paying electronically it is critical that electronic payment options are available no matter where and when clients want to pay their bills.

Make sure you have all the bases covered

Increase electronic payments by making it easier for clients to pay electronically.

Web payments

- Provide your customers with the ability to pay right on your website, one time or set up recurring payments. Quick, easy and low cost. Allows clients to pay anytime, 24X7.

IVR (phone payments)

- Ever call an 800 number to pay a bill and the computer walks you through step by step to make a payment? Now you know what IVR is all about. English, Spanish and French, no problem.

Electronic lockbox

- Do you wonder why the number of paper checks is not going down while the number of customers paying from their on-line bank keeps going up? Often when a banking customer pays a bill with the online banking service, the bank will actually print and mail the check on behalf of the client. These bank checks are often without the remittance information, requiring extra handling in the Accounts Receivable department.

- An electronic lockbox can turn more of those “would be paper checks” into an electronic payment, speeding up the cash flow and reducing handling costs.

Pay from the PDF attachment

- eBills can be delivered to clients as a link back to a website or as a PDF attachment. One way to simplify the payment process for the client and speed up cash flow is to enable customers to pay right from the PDF. By PUSHing the bills to the customer as an encrypted attachment to an email, it’s just as if the client were receiving the “letter” in their mailbox. Only this time it is their email box instead of their physical mailbox.

- Payment is simplified by enabling payment from any device (computer, phone, tablet) with one or two clicks. No user name or password are required; yet the transaction is highly secure.

- Because of the simplicity of the user experience, paperless adoption rates are 2 -3 X the industry average and can be used for all document types: invoices, statements, policies notices etc., and

- Provides a fantastic vehicle for transpromotional messaging and cross selling to increase customer loyalty and grow revenues.

POS and Kiosk

- If payment is received at the office or store, there are a variety of ways to enhance the customer experience and minimize clerical time. Point of Sale options can range from a simple PC virtual terminal, with or without a card reader, to a self-standing kiosk.

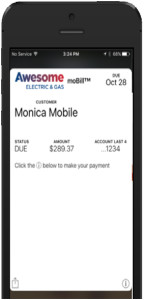

Paying from a Mobile device

- No doubt about it, having a viable mobile payment option is critical to any successful collections process. People are spending more and more time on their mobile devices and do not want to have to change devices to make a payment.

- Mobile payment options

- Secure Webpay – Direct clients to a mobile optimized website to securely pay their bill.

- One click payment – Or better yet, enable a one click right payment from the email. View the email and hit pay, and bam, payment done.

- Mobile Wallets – A third option is to use the mobile Wallet apps (Apple Wallet or Google’s Android Pay) to view and pay bills.

- Card Reader: add a Card Reader to your mobile device to capture card information